Redefining the landscape of government, corporate & retail operations in the digital age

Design Your Future

ready-to-use Microservices on Cloud

APIs

Events

About Us

12 Products, 5 Platforms &

4 Exponential Technologies

Customers

enabled FinTech Platform for Global Leaders

Countries

Full Spectrum Banking &

Insurance Technologies

World’s First FinTech Design Center

for Financial Institutions

Webinars

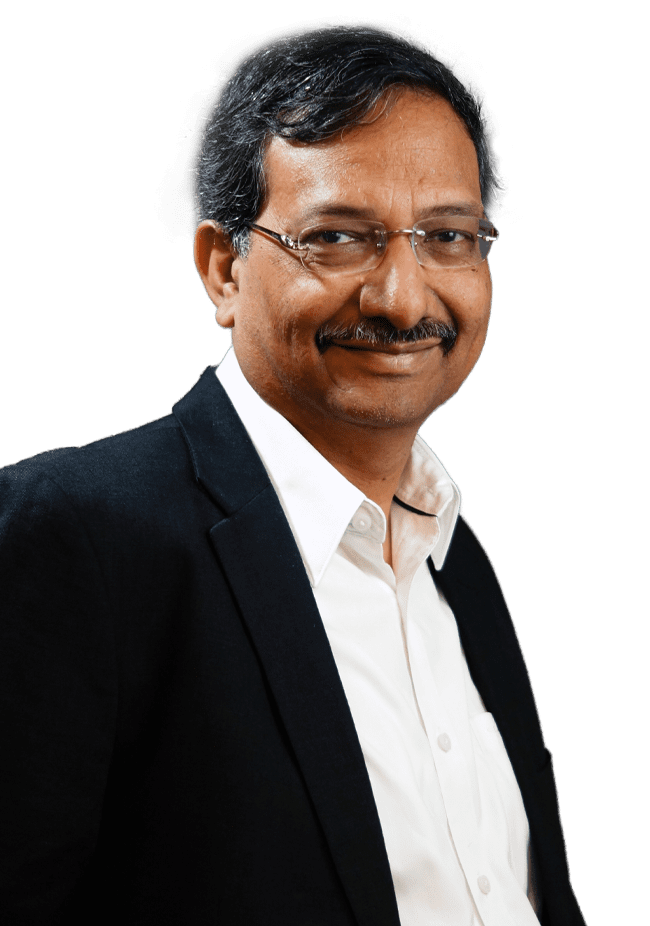

Chairman & Managing Director

Intellect Design Arena Limited

News

Insights

Careers

Our customer-first approach has always driven us to deliver bespoke financial solutions that are backed by the principles of design thinking. In this way, we have fostered a culture of experimentation, exploration, and collaboration to create industry-leading products and solutions that add value to our customers’ journeys, every step of the way.

Learn MoreIntellect

Intellect

Nationalities

Nationalities

Languages

Languages

At the core of our culture is a rich and truly diverse work environment that is bustling with creative energy and individual perspectives.

Learn More

We believe that good design is at the heart

of better business.